Are you ready to explore the dynamic world of raw materials and expand your trading horizons? Pepperstone Commodities provides an exceptional gateway to global markets, empowering traders like you with confidence. We understand the thrill of seizing opportunities in commodity trading, and our platform is designed to make that experience seamless and rewarding.

Engaging with Pepperstone Commodities means accessing a diverse array of global raw materials, from precious metals to energy resources. We bring the markets directly to you, offering the tools and insights necessary to make informed decisions and execute your strategy effectively.

From the foundational energy sources that power our world to the precious metals that secure wealth, commodity markets offer unique avenues for diversification and growth. Discover how you can participate in these essential markets with robust tools and dedicated support.

- Discover the Breadth of Commodity Trading

- Why Choose Pepperstone for Your Commodity Trades?

- Ready to Start Trading Commodities?

- Understanding Commodities: An Overview

- What are the Main Types of Commodities?

- Why Do Investors Engage in Commodity Trading?

- Why Trade Commodities with Pepperstone?

- Unrivaled Market Access and Diversity

- Competitive Edge with Superior Trading Conditions

- Powerful Platforms and Tools at Your Fingertips

- Exceptional Support and Trusted Regulation

- Regulatory Safeguards for Traders

- Key Regulatory Protections You Benefit From:

- Why Regulatory Compliance Matters for Your Trades:

- Competitive Pricing on Pepperstone Commodities

- Exploring Pepperstone’s Range of Commodities

- Key Commodity Categories at Pepperstone

- Why Trade Pepperstone Commodities?

- A Glimpse at Our Offerings

- Energy Commodities: Oil & Gas

- Precious Metals: Gold, Silver & More

- Gold: The Ultimate Safe Haven

- Silver: Gold’s Dynamic Counterpart

- Beyond Gold and Silver

- Why Consider Precious Metals in Your Trading Strategy?

- Agricultural Commodities: Softs & Grains

- The Mechanics of Commodity CFDs

- What is a Commodity CFD?

- How Commodity CFDs Operate

- Key Components of Commodity CFD Trading

- Types of Commodities Available via CFDs

- Advantages and Risks

- Advantages

- Risks

- Leverage and Margin Requirements Explained

- What is Leverage? Amplifying Your Market Power

- Understanding Margin: Your Security Deposit

- Leverage and Margin with Pepperstone Commodities

- Spreads, Swaps, and Trading Costs

- The Spread: Your Primary Transaction Cost

- Understanding Swaps: Overnight Financing

- Other Potential Trading Costs

- Choosing Your Trading Platform for Commodities

- Key Factors to Consider

- Effective Risk Management in Commodity Trading

- Core Principles for Managing Commodity Risk

- Practical Strategies for Disciplined Trading

- The Psychological Edge in Risk Management

- Developing Robust Commodity Trading Strategies

- Market Volatility and Trading Hours

- Pepperstone Account Types for Commodity Traders

- Funding and Withdrawal Processes

- Fund Your Trading Account Instantly

- Transparent and Efficient Withdrawals

- Your Capital, Your Control

- Accessing Educational Resources and Analysis

- The Benefits of Diversifying with Commodities

- Protection Against Inflation

- Low Correlation with Traditional Assets

- Market Opportunities Across Sectors

- Tangible Value and Real-World Demand

- Portfolio Performance Enhancement

- Getting Started: Your First Pepperstone Commodities Trade

- Your Quick Setup Checklist

- Understanding the World of Raw Materials

- Choosing Your First Commodity to Trade

- Placing Your First Trade: A Step-by-Step Guide

- Monitoring and Managing Your Position

- Frequently Asked Questions

Discover the Breadth of Commodity Trading

With Pepperstone, you gain access to a powerful platform built for commodity trading. This includes a comprehensive selection of raw materials, giving you extensive options to diversify your portfolio. Whether you focus on specific markets or prefer a broad approach, our platform offers the flexibility you need.

- Precious Metals: Trade gold, silver, and other sought-after metals, often seen as safe-haven assets.

- Energy Commodities: Capitalize on movements in the oil market and other energy commodities.

- Agricultural Products: Explore opportunities in soft commodities, connecting you to fundamental global supply and demand.

Why Choose Pepperstone for Your Commodity Trades?

We believe in providing a superior trading environment. When you choose Pepperstone Commodities, you benefit from a combination of robust technology, competitive conditions, and dedicated support.

“Accessing gold silver oil with Pepperstone has been a game-changer for my diversification strategy. The platform is intuitive, and the execution speeds are impressive.”

— An Experienced Trader

Our commitment extends to ensuring you have the best possible experience. Here is what sets us apart:

| Feature | Benefit to You |

|---|---|

| Competitive Spreads | Potentially lower trading costs on various raw materials. |

| Fast Execution | Quick entry and exit from positions, crucial in volatile markets. |

| Advanced Platforms | Access to leading trading software with powerful analytical tools. |

| Dedicated Support | Expert assistance whenever you need it to navigate energy commodities and more. |

Pepperstone Commodities makes it straightforward to participate in global markets. We cut through the complexity, allowing you to focus on your strategy, whether you are interested in gold silver oil or broader energy commodities.

Ready to Start Trading Commodities?

Take the next step with Pepperstone Commodities. Embrace the opportunities presented by global raw materials and trade with a partner who prioritizes your success. Join us today and discover how confidently you can navigate the world of commodity trading.

Understanding Commodities: An Overview

Commodities form the bedrock of the global economy. These are essential goods, often raw materials, that are interchangeable with other goods of the same type. Think of them as the fundamental building blocks our world runs on, from the energy powering our homes to the food on our tables and the precious metals in our electronics.

Engaging in commodity trading offers a unique path for diversification and potential profit. It involves buying and selling these base goods, rather than traditional assets like stocks or bonds, providing a different dimension to market participation.

What are the Main Types of Commodities?

Commodities typically fall into several key categories, each with its own market dynamics and influences:

- Energy Commodities: These power our world. Think crude oil, natural gas, and gasoline. As vital energy sources, these energy commodities are often highly volatile and react quickly to global geopolitical events and supply-demand shifts.

- Metals: This category splits into precious and industrial metals. Precious metals like gold, silver, and platinum often serve as safe havens during economic uncertainty. Industrial metals such as copper and aluminum are critical for manufacturing and infrastructure development worldwide.

- Agricultural Commodities: Covering everything from wheat and corn to coffee and sugar, these are vital for food production and consumption. Weather patterns, harvest yields, and global demand significantly impact their prices.

Why Do Investors Engage in Commodity Trading?

There are several compelling reasons market participants turn to commodities:

| Benefit | Description |

|---|---|

| Diversification | Commodities often show a low correlation with other asset classes, helping to balance a portfolio. |

| Inflation Hedge | As raw materials, commodities can maintain their value or even increase during periods of inflation. |

| Profit Potential | Price fluctuations in commodities, driven by supply and demand, create opportunities for capital growth. |

Whether you’re interested in the traditional appeal of gold silver oil or the dynamic shifts in energy commodities, understanding the market nuances is key. Platforms like Pepperstone Commodities provide robust avenues to explore this diverse market, offering access to a wide range of global raw materials. Dive in and discover how these foundational assets can fit into your trading strategy.

Why Trade Commodities with Pepperstone?

Diving into the world of commodity trading opens up exciting possibilities. Traders often seek volatility and diversification, and raw materials offer exactly that. When you consider the vast potential in markets like gold, silver, or oil, choosing the right broker becomes paramount. This is where Pepperstone truly stands out, making your experience with Pepperstone Commodities both efficient and rewarding.

Unrivaled Market Access and Diversity

Pepperstone provides a comprehensive gateway to a wide array of global commodities. We understand the importance of choice, offering you exposure to markets that move with global events and supply-demand dynamics. This means you can diversify your portfolio beyond traditional assets and seize opportunities in various sectors.

- Precious Metals: Trade popular assets like gold and silver, often considered safe havens during economic uncertainty.

- Energy Commodities: Access major energy markets, including various types of oil and natural gas, directly influenced by geopolitical shifts and production levels.

- Soft Commodities: Explore agricultural products, offering unique market characteristics.

Competitive Edge with Superior Trading Conditions

Pepperstone commitment to tight spreads and fast execution gives you a distinct advantage. This translates to lower trading costs and the ability to enter and exit positions precisely when you need to.

Here’s a snapshot of what to expect:

| Feature | Benefit to You |

|---|---|

| Tight Spreads | Reduce your trading costs significantly. |

| Rapid Execution | Minimize slippage and capitalize on fleeting market movements. |

| Flexible Leverage | Amplify your potential returns with managed risk. |

Powerful Platforms and Tools at Your Fingertips

Successful commodity trading demands robust platforms equipped with advanced analytical tools. Pepperstone empowers you with industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader. These platforms offer intuitive interfaces, comprehensive charting tools, and customizable features to suit your individual trading style.

“Accessing real-time data and executing trades with precision is essential. Pepperstone platforms provide the stability and speed traders need to navigate the dynamic commodity markets effectively.”

Exceptional Support and Trusted Regulation

Your peace of mind is our priority. Pepperstone operates under strict regulatory oversight from multiple global bodies, ensuring a secure and transparent trading environment. Furthermore, our dedicated client support team is available around the clock to assist you with any questions or technical needs, ensuring a smooth trading journey. We pride ourselves on responsive and knowledgeable service that truly makes a difference.

Choosing to trade Pepperstone Commodities means partnering with a broker committed to your success. We provide the tools, conditions, and support necessary to confidently explore the exciting world of raw materials, from gold silver oil to a wide range of energy commodities and beyond. Take control of your trading future today.

Regulatory Safeguards for Traders

Navigating the dynamic world of commodity trading demands confidence and security. At Pepperstone, we understand that robust regulatory oversight isn’t just a compliance formality; it’s the bedrock of a trustworthy trading experience. When you engage with Pepperstone Commodities, you trade with peace of mind, knowing your investments are protected by stringent regulatory safeguards designed to shield your interests.

Our commitment to regulatory excellence means we operate under the watchful eyes of several top-tier financial authorities globally. These regulators enforce strict rules that ensure fairness, transparency, and accountability across all trading activities. This framework protects your capital and ensures we maintain the highest operational standards in the industry.

Key Regulatory Protections You Benefit From:

- Client Fund Segregation: Your trading capital is held in segregated client accounts, entirely separate from Pepperstone’s operational funds. This critical measure ensures your money remains secure and inaccessible to the firm for its own purposes, even in unforeseen circumstances.

- Regulatory Reporting & Audits: We adhere to rigorous reporting requirements set by regulatory bodies. Regular audits by independent firms verify our financial stability and compliance with all applicable regulations, offering an additional layer of security for your commodity trading activities.

- Investor Compensation Schemes: Depending on your jurisdiction, you may be covered by investor compensation schemes. These programs provide a safety net, offering protection for eligible clients in the unlikely event of a broker’s insolvency.

Trading raw materials like gold, silver, oil, and other energy commodities requires a platform you can trust. Our adherence to global regulatory standards means you receive fair execution, transparent pricing, and robust risk management tools.

Why Regulatory Compliance Matters for Your Trades:

| Benefit to Trader | How Regulations Deliver It |

|---|---|

| Enhanced Security | Mandatory client fund segregation and financial reporting. |

| Fair Trading Environment | Rules against market manipulation and predatory practices. |

| Transparency | Clear disclosure of fees, terms, and trading conditions. |

| Accountability | Regulatory bodies can investigate and penalize non-compliant brokers. |

We empower our traders through comprehensive education and by fostering a secure trading environment. With Pepperstone Commodities, you focus on market analysis and strategy, confident in the robust regulatory foundation supporting your journey into the world of diverse raw materials.

Competitive Pricing on Pepperstone Commodities

In the fast-paced world of commodity trading, securing an edge often comes down to the costs you incur. Pepperstone Commodities consistently delivers exceptionally competitive pricing, a crucial factor designed to empower your trading strategy and enhance your potential returns.

We understand that every pip counts. Our commitment to tight spreads and low commissions means more of your capital stays in your account, directly impacting your profitability. This sharp focus on value is applied across our entire spectrum of raw materials, ensuring you gain a significant advantage in the market.

How do we manage to offer such compelling pricing for Pepperstone Commodities? It’s a combination of strategic advantages:

- Deep Liquidity Access: We partner with a diverse range of top-tier liquidity providers, creating a robust pool that ensures tight, consistent spreads even during volatile market conditions.

- Advanced Trading Technology: Our cutting-edge platforms are engineered for speed and precision. This technological superiority minimizes slippage and guarantees rapid trade execution, keeping your costs down.

- Efficient Cost Structures: We continually optimize our operational efficiency. This allows us to pass on significant savings to you, without compromising on service quality or trading experience.

This dedication to cost-efficiency isn’t just theoretical. It directly benefits your trading on popular instruments like gold silver oil, where even fractions of a cent can make a substantial difference over many trades. The same principle applies to other crucial energy commodities and agricultural products, ensuring consistent value across the board.

“Competitive pricing isn’t just about saving money; it’s about maximizing opportunities and keeping more of your profits. That’s our promise at Pepperstone Commodities.”

Choosing Pepperstone means choosing a partner committed to your success. Explore the clear benefits our competitive pricing brings to your commodity trading and experience a truly advantageous trading environment.

Exploring Pepperstone’s Range of Commodities

Unlock diverse trading opportunities by exploring Pepperstone Commodities. We empower you to delve into dynamic global markets, offering a comprehensive selection of raw materials that are central to the world economy. Whether you’re a seasoned trader or just starting your journey, our platform provides the tools and access you need for effective commodity trading.

Commodities represent fundamental building blocks of industry and daily life. Their value fluctuates based on supply, demand, and geopolitical events, creating exciting prospects for traders seeking portfolio diversification and potential gains. With Pepperstone, you can confidently engage with these essential assets.

Key Commodity Categories at Pepperstone

We bring you an extensive array of essential raw materials, allowing you to react to market shifts across various sectors. Here’s a glimpse into the diverse markets you can access:

- Precious Metals: Trade popular instruments like gold, silver, and platinum. These assets often serve as safe havens during economic uncertainty and offer unique trading dynamics.

- Energy Commodities: Tap into the volatile world of energy commodities, including crude oil and natural gas. Global events significantly impact these markets, presenting frequent opportunities.

- Soft Commodities: Engage with agricultural products such as coffee, sugar, and cotton, which respond to weather patterns, harvest forecasts, and consumer demand.

- Industrial Metals: Access metals critical for manufacturing and infrastructure, reflecting global economic health.

Why Trade Pepperstone Commodities?

Choosing Pepperstone for your commodity trading opens doors to a premier trading experience. We focus on delivering an environment that supports your trading goals with cutting-edge technology and client-centric services.

Here are some distinct advantages:

- Competitive Spreads: We strive to provide tight spreads on a wide variety of raw materials, helping you manage your trading costs effectively.

- Advanced Platforms: Access world-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader, equipped with robust analytical tools and customizable features.

- Flexible Leverage: We offer flexible leverage options, allowing you to amplify your trading power while managing your risk exposure responsibly.

- Reliable Execution: Our technology ensures swift and dependable trade execution, crucial for seizing fast-moving opportunities in the commodity markets.

A Glimpse at Our Offerings

To give you a clearer picture, here’s a small sample of the popular Pepperstone Commodities you can trade:

| Commodity Type | Popular Instruments |

|---|---|

| Metals | Gold, Silver, Platinum |

| Energy | Crude Oil, Natural Gas |

| Softs | Coffee, Sugar, Cotton |

Ready to engage with these vital markets? Pepperstone equips you with the resources and reliability to navigate the complexities of commodity trading effectively. Join us and discover your potential.

Energy Commodities: Oil & Gas

Delving into the world of energy commodities, we find markets buzzing with constant activity. These vital raw materials power industries, move transportation, and heat homes across the globe. Understanding the dynamics of these markets is crucial for anyone engaged in commodity trading.

Crude oil stands as a titan among energy commodities. It is not just a fuel; it is a geopolitical force, a key indicator of economic health, and a liquid gold. Prices swing based on global supply disruptions, shifts in demand, geopolitical tensions, and even weather patterns. Trading crude oil requires a sharp eye on these myriad influences, offering both significant opportunities and inherent risks.

- Supply & Demand: OPEC+ decisions, shale production levels, and industrial consumption directly impact pricing.

- Geopolitical Stability: Conflicts in major oil-producing regions can send shockwaves through the market.

- Economic Growth: A booming global economy typically means higher demand for oil, pushing prices up.

- Technological Advancements: Innovations in extraction or alternative energy sources can shift the long-term outlook.

Natural gas, another cornerstone of energy commodities, plays an increasingly important role in the global energy mix, particularly in power generation and heating. Its price movements are often distinct from oil, heavily influenced by seasonal weather patterns, storage levels, and pipeline infrastructure. Severe winters or hot summers can dramatically impact demand and, consequently, prices.

For those considering a venture into energy commodities, understanding the unique characteristics of each market is paramount. Both oil and natural gas offer distinct trading environments:

| Characteristic | Crude Oil | Natural Gas |

| Global Reach | Extremely global, highly liquid | More regional, though growing global LNG trade |

| Price Drivers | Geopolitics, OPEC decisions, global economic health | Weather, storage levels, infrastructure outages |

| Volatility | Often high, influenced by major global events | Can be extreme, especially seasonally |

The allure of these markets lies in their volatility and the clear economic forces at play. Whether your interest lies in gold silver oil or exploring the broader spectrum of energy commodities, these markets demand attention. Pepperstone Commodities provides a gateway to these dynamic raw materials, enabling you to participate in the global energy story. Embrace the challenge and potential rewards that come with active commodity trading.

Precious Metals: Gold, Silver & More

Diving into the world of precious metals offers a unique thrill within commodity trading. These aren’t just shiny objects; they are vital raw materials with deep historical significance and enduring market appeal. Many investors turn to these assets for stability and growth, making them a cornerstone of any diversified portfolio.

Gold: The Ultimate Safe Haven

Gold stands as the quintessential precious metal. For centuries, it has been a symbol of wealth, power, and security. Traders often flock to gold during times of economic uncertainty or geopolitical tension, viewing it as a reliable safe-haven asset. Its value tends to rise when other markets falter, offering a hedge against inflation and currency devaluation. It’s a consistently popular choice among those exploring Pepperstone Commodities.

Silver: Gold’s Dynamic Counterpart

Silver, often called “poor man’s gold,” shares many characteristics with its gleaming cousin but boasts a unique profile. It serves a dual role: a precious metal for investment and a crucial industrial raw material. Its use in electronics, solar panels, and medical devices means its price can be influenced by manufacturing demand as much as investor sentiment. This makes silver’s price movements often more volatile than gold’s, presenting distinct opportunities for active traders.

Beyond Gold and Silver

While gold and silver dominate the spotlight, other precious metals also offer intriguing possibilities:

- Platinum: Scarcer than gold, platinum is a vital component in automotive catalysts and jewelry. Its price is often closely tied to industrial demand.

- Palladium: Even rarer than platinum, palladium is another critical metal in catalytic converters. Its market can experience significant price swings based on supply and demand dynamics from the auto industry.

Why Consider Precious Metals in Your Trading Strategy?

Trading precious metals like gold and silver through Pepperstone Commodities offers several compelling advantages:

| Feature | Gold | Silver |

| Primary Role | Safe-haven, wealth preservation | Industrial use, investment |

| Volatility | Generally lower, steady appreciation | Higher, more dynamic price swings |

| Liquidity | Very high | High |

These raw materials provide excellent diversification potential, allowing you to balance risk across your trading portfolio. Whether you seek the stability of gold or the dynamic potential of silver, the precious metals market offers diverse avenues for engagement. Embrace the opportunity to trade these enduring assets.

Agricultural Commodities: Softs & Grains

Welcome to the dynamic world of agricultural commodities, where everyday essentials become exciting opportunities for savvy traders. These vital raw materials form the backbone of global economies, influencing everything from your morning coffee to the bread on your table. Understanding these markets is key to successful commodity trading.

Exploring Softs: Nature’s Volatility

Soft commodities are agricultural products that are typically grown rather than mined. They often have shorter shelf lives and are highly susceptible to weather patterns, disease, and seasonal cycles. This inherent volatility creates frequent price movements, offering distinct opportunities for those engaged in commodity trading.

- Coffee: From robusta to arabica, global demand keeps this market brewing. Production reports from Brazil and Vietnam often dictate price direction.

- Sugar: Sweet opportunities abound, influenced by harvests in major producing nations like India and Thailand, alongside shifting global consumption patterns.

- Cocoa: The essential ingredient for chocolate, heavily dependent on West African production, where political stability and weather play crucial roles.

- Cotton: A key textile raw material, with prices reacting to global fashion trends, economic growth, and harvests from countries such as China and the United States.

Grains: Feeding the World’s Demand

Grains are staple crops, forming a fundamental part of diets worldwide. Their large-scale production and critical role in food security make them major players in the commodity trading landscape. Factors like government policies, trade agreements, and even drought in major growing regions can dramatically shift prices for these essential raw materials.

- Wheat: A global staple, vital for bread and pasta, with major producers including Russia, the US, and Canada. Geopolitical events often impact its market.

- Corn: Used for food, animal feed, and ethanol, making it one of the most actively traded grains globally, heavily influenced by US harvests.

- Soybeans: Crucial for oil and protein meal, heavily influenced by demand from China and South American production figures.

Why Trade Agricultural Raw Materials?

Trading agricultural commodities offers unique diversification benefits and exposure to global supply and demand dynamics. Unlike some other asset classes, these markets are directly influenced by tangible, real-world factors. Weather reports, crop yield forecasts, and geopolitical events can all fuel significant price action.

Ready to explore these essential markets? Pepperstone Commodities provides access to a diverse range of these raw materials, empowering you to participate in the global commodity trading arena.

The Mechanics of Commodity CFDs

Understanding the underlying mechanics of Commodity CFDs is crucial for anyone venturing into this dynamic market. You’re not just trading; you’re engaging with the fundamental forces of supply and demand for essential **raw materials** worldwide. Let’s peel back the layers and see how these instruments work.What is a Commodity CFD?

A CFD, or Contract for Difference, is an agreement to exchange the difference in the price of an asset from the time the contract is opened until it is closed. When you trade Commodity CFDs, you speculate on the price movements of various commodities without ever owning the physical asset itself. This allows for flexible participation in **commodity trading**. Consider these core aspects:- Price Speculation: Your profit or loss depends purely on whether the price of the commodity moves in your favor.

- No Physical Ownership: You won’t take delivery of barrels of oil or gold bars. This removes logistical complexities.

- Leverage: CFDs often allow you to control a large position with a relatively small amount of capital (margin).

How Commodity CFDs Operate

Trading **Pepperstone Commodities** through CFDs means you open a position based on your prediction of future price action. Here’s a quick look at the operational flow:- Choose Your Commodity: Select from a range including precious metals like **gold silver oil**, agricultural products, or **energy commodities**.

- Open a Position: If you expect the price to rise, you ‘buy’ (go long). If you anticipate a fall, you ‘sell’ (go short).

- Monitor the Market: The CFD’s value moves in tandem with the underlying commodity’s market price.

- Close Your Position: You close the trade by executing the opposite transaction (selling if you bought, buying if you sold). Your profit or loss is the difference between the opening and closing prices, multiplied by your position size.

Key Components of Commodity CFD Trading

Several elements come into play when you engage with Commodity CFDs. Grasping these helps you make more informed decisions.Leverage and Margin

Leverage amplifies both potential profits and losses. You deposit a small percentage of the total trade value (known as margin), and your broker provides the rest. While exciting, leverage demands respect and careful risk management.Spreads and Commissions

A spread is the difference between the buy and sell price of a CFD. It represents a cost of trading. Some brokers might also charge a small commission, particularly on popular instruments like **gold silver oil**.Rollover/Swap Costs

If you hold a CFD position overnight, you might incur a small financing charge or credit, known as a rollover or swap cost. This reflects the cost of borrowing to maintain the leveraged position.Types of Commodities Available via CFDs

The world of **Pepperstone Commodities** offers diverse opportunities, covering a broad spectrum of **raw materials**:| Category | Examples |

|---|---|

| Metals | Gold, Silver, Platinum |

| Energy | Crude Oil, Natural Gas, Heating Oil |

| Agriculture | Wheat, Corn, Coffee, Sugar |

Advantages and Risks

Every financial instrument comes with its own set of pros and cons. Commodity CFDs are no exception.Advantages

- Access to Global Markets: Trade a vast range of **raw materials** from a single platform.

- Leverage Potential: Magnify returns with a smaller initial capital outlay.

- Go Long or Short: Profit from both rising and falling markets.

- No Physical Ownership Hassles: Avoid storage, insurance, or delivery concerns.

Risks

- Leverage Magnifies Losses: Just as it amplifies gains, leverage can quickly multiply losses.

- Market Volatility: Commodity prices can swing dramatically, leading to rapid changes in your position’s value.

- Margin Calls: If your position moves against you, you might need to deposit more funds to maintain your trade.

- Overnight Costs: Holding positions for extended periods can incur rollover fees.

Leverage and Margin Requirements Explained

Unlocking the full potential of commodity trading means understanding powerful tools like leverage and margin. These concepts are fundamental to participating in markets, especially when dealing with a diverse range of raw materials.

What is Leverage? Amplifying Your Market Power

Leverage essentially allows you to control a larger market position with a relatively smaller amount of capital. Think of it as a financial amplifier. When you trade with leverage, you put down a fraction of the total trade value, and your broker covers the rest. This means you can significantly increase your exposure to price movements in various instruments, from gold silver oil to energy commodities.

Leverage can dramatically magnify both your potential profits and losses. A small price change in the underlying asset can result in a much larger return or drawdown on your initial capital. It is a double-edged sword that demands respect and a solid risk management strategy.

Leverage provides opportunity, but discipline dictates success.

Understanding Margin: Your Security Deposit

While leverage boosts your trading power, margin acts as the security deposit or collateral required by your broker to keep your leveraged positions open. It’s not a fee but rather a portion of your account equity set aside to cover potential losses. Your broker holds this margin to ensure you can meet your obligations.

There are typically two types of margin you will encounter:

- Initial Margin: This is the amount of capital you must have in your account to open a leveraged position.

- Maintenance Margin: Once a position is open, your account equity must remain above this level. If your equity falls below the maintenance margin due to market movements against your position, you might face a margin call, requiring you to deposit more funds or close positions.

Margin requirements vary based on the instrument’s volatility, the specific raw materials you trade, and the leverage offered. For highly volatile assets like certain energy commodities, margin requirements might be higher to mitigate risk for both the trader and the broker.

Leverage and Margin with Pepperstone Commodities

With Pepperstone Commodities, you gain access to a wide array of markets, and understanding how our leverage and margin requirements work is key to an effective commodity trading strategy. We provide clear guidelines, allowing you to manage your risk while pursuing opportunities in everything from precious metals like gold silver oil to other crucial raw materials.

Here’s a quick look at how leverage affects required margin:

| Leverage Ratio | Required Margin (% of Trade Value) | Example: $10,000 Position |

|---|---|---|

| 1:30 | 3.33% | $333.33 |

| 1:100 | 1.00% | $100.00 |

| 1:500 | 0.20% | $20.00 |

The table clearly shows that higher leverage means a lower percentage of required margin for the same trade value. However, this also means greater exposure to market fluctuations. Successful commodity trading involves carefully balancing the power of leverage with a prudent approach to margin, ensuring you always have sufficient capital to navigate market volatility.

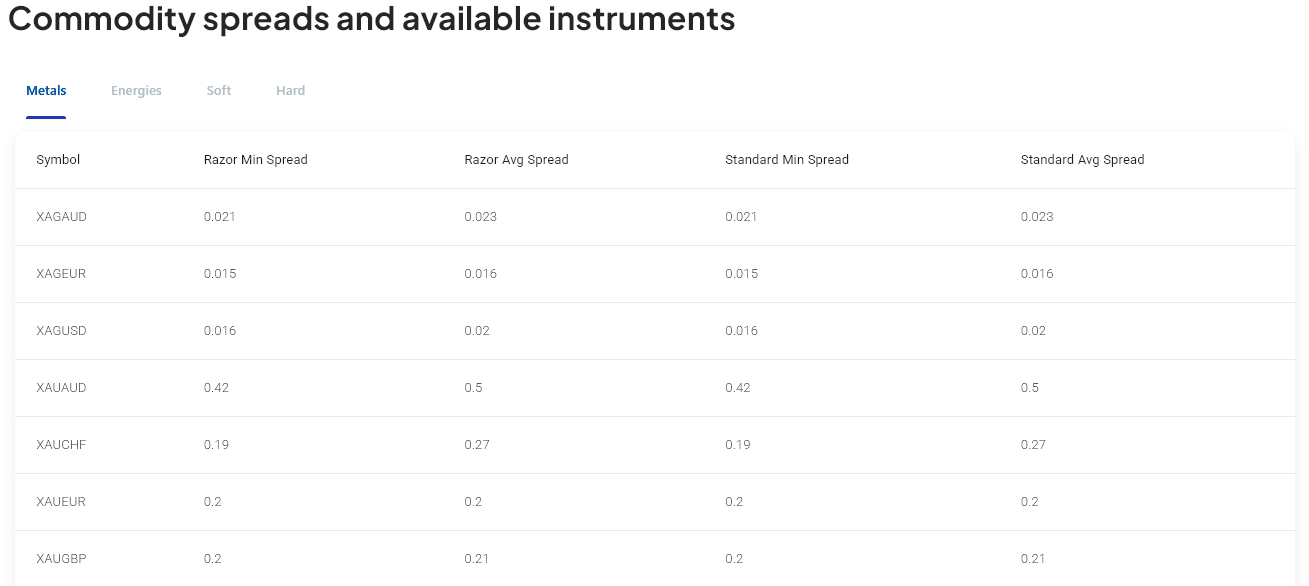

Spreads, Swaps, and Trading Costs

Successful commodity trading demands a clear understanding of costs. When you delve into the world of raw materials with Pepperstone Commodities, several key elements shape your overall transaction expense. Knowing these upfront helps you manage capital effectively and refine your trading decisions, moving you closer to your financial goals.

The Spread: Your Primary Transaction Cost

The spread represents the difference between the buy (ask) and sell (bid) price of an asset. It is your most direct trading cost. With Pepperstone Commodities, you typically experience competitive spreads, a vital factor for active traders. A tighter spread means a lower immediate cost to enter and exit a position, making your commodity trading potentially more efficient.

- Tight Spreads: We strive to offer some of the tightest spreads in the market, reducing your upfront transaction costs.

- Variable Nature: Spreads can fluctuate based on market volatility, liquidity, and the specific raw materials you trade. Be aware of market conditions when dealing with popular energy commodities or precious metals like gold silver oil.

- No Fixed Fees: For most commodity CFDs, the spread is the primary cost, eliminating additional fixed commissions on each trade.

Understanding Swaps: Overnight Financing

Swaps, also known as overnight financing, are an interest charge or credit applied to positions held open past the market’s daily closing time. They reflect the interest rate differential between the currencies involved in the underlying asset. For Pepperstone Commodities, swaps significantly impact any position you hold for more than a single trading day.

Whether you receive a credit or incur a charge depends on several factors: the specific commodity, whether your position is long (buy) or short (sell), and prevailing interest rates. Holding a long position on certain raw materials might incur a debit, while a short position could potentially earn a credit, or vice-versa.

| Position Type | Impact on Trading Account | Consideration for |

|---|---|---|

| Long (Buy) | Typically incurs a debit (cost) | Extended holdings of energy commodities |

| Short (Sell) | Often receives a credit (gain) | Short-selling gold silver oil over several days |

“Transparent swap rates are crucial for long-term strategies. Always check these rates before committing to an overnight position in the Pepperstone Commodities market.”

Other Potential Trading Costs

While spreads and swaps form the core of your trading expenses with Pepperstone Commodities, always remain aware of other potential fees. For most commodity trading, Pepperstone aims for a straightforward cost structure. However, factors like inactivity fees (for dormant accounts) or potential conversion fees (if your account currency differs from the commodity’s base currency) can occasionally apply. We encourage you to review the full terms and conditions to ensure complete cost transparency.

By thoroughly understanding these cost components, you gain a sharper edge in your commodity trading journey. Pepperstone is committed to providing a transparent trading environment, empowering you to make confident decisions when exploring the vast opportunities in raw materials.

Choosing Your Trading Platform for Commodities

Selecting the right trading platform is a pivotal decision for anyone venturing into the dynamic world of commodity trading. Your choice significantly impacts your access, execution speed, analytical tools, and ultimately, your trading success. A powerful platform equips you to navigate the volatile markets of raw materials with confidence and precision.

When you evaluate options for trading Pepperstone Commodities or any other assets, focus on several key areas to ensure the platform aligns with your strategic goals. Making an informed decision here sets the foundation for a productive trading experience.

Key Factors to Consider

- Regulatory Compliance and Security: Prioritize platforms regulated by reputable financial authorities. This provides a crucial layer of protection for your funds and personal information. Look for robust security measures, including data encryption and secure login protocols.

- Range of Commodities: A top-tier platform offers a diverse selection of commodities. You want access to everything from popular energy commodities like crude oil and natural gas to precious metals such as gold silver oil, and agricultural products. This variety allows for broader market exposure and diversification of your portfolio.

- Trading Tools and Features: Evaluate the platform’s analytical capabilities. Does it offer advanced charting tools, technical indicators, and real-time market data? A user-friendly interface that allows for quick order execution and customizable layouts enhances your trading efficiency.

- Pricing and Spreads: Understand the commission structure, spreads, and any hidden fees. Competitive pricing directly impacts your profitability. Transparent fee structures are always a strong indicator of a trustworthy broker.

- Customer Support: Responsive and knowledgeable customer support is invaluable. When you encounter an issue or have a question, prompt assistance ensures minimal disruption to your trading activities. Look for platforms offering multiple contact methods and extended support hours.

- Execution Speed: In fast-moving commodity markets, execution speed can be the difference between profit and loss. Choose a platform known for reliable and quick trade execution, minimizing slippage and ensuring your orders are filled at the desired prices.

The right trading platform acts as your command center. It empowers you to analyze market trends, manage risk effectively, and capitalize on opportunities across various raw materials. Carefully assessing these factors will guide you toward a platform that supports your journey in commodity trading, providing the tools and environment you need to thrive.

Effective Risk Management in Commodity Trading

Navigating the dynamic world of commodity trading demands more than just market savvy. It requires an iron-clad risk management strategy. While the allure of significant gains from movements in raw materials like gold, silver, or oil is powerful, the inherent volatility of these markets also presents substantial risks. Mastering risk management protects your capital and positions you for sustained success in commodity trading.

Core Principles for Managing Commodity Risk

Successful traders understand that capital preservation is paramount. Before eyeing profits, focus on preventing devastating losses. Here are fundamental principles to build your defense:

- Define Your Risk Tolerance: Understand how much you are comfortable losing on any single trade or overall. Never risk more than you can truly afford to lose.

- Implement Stop-Loss Orders: These are non-negotiable. A stop-loss automatically closes your position once a predefined price level is hit, limiting potential downside. This is a critical tool for any trader dealing with Pepperstone Commodities or similar offerings.

- Appropriate Position Sizing: Never allocate too much capital to a single trade. A common rule suggests risking no more than 1-2% of your total trading capital on any one position.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Spreading your investments across different raw materials, such as various energy commodities or precious metals, can mitigate risk. If one commodity falters, others might perform well.

- Understand Leverage: Leverage can amplify both profits and losses. Use it cautiously, fully understanding its implications for your capital.

Practical Strategies for Disciplined Trading

Implementing effective risk management goes beyond just understanding principles; it involves consistent execution and strategic planning. A robust approach helps you navigate the ups and downs of commodity trading with greater confidence.

Consider these actionable steps:

“The biggest risk is not taking any risk… In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” – Mark Zuckerberg (adapted for trading context: the biggest risk is taking *unmanaged* risk.)

- Develop a Trading Plan: Outline your entry and exit points, profit targets, and stop-loss levels before you execute any trade.

- Maintain a Favorable Risk-Reward Ratio: Always aim for trades where the potential profit significantly outweighs the potential loss. A common target is a 1:2 or 1:3 risk-reward ratio, meaning you aim to gain at least twice or three times what you stand to lose.

- Monitor Market News and Events: Geopolitical events, supply chain disruptions, and economic data can drastically impact commodity prices. Staying informed helps anticipate potential shifts for gold silver oil or other raw materials.

- Regularly Review and Adjust: After each trade, analyze your performance. What went well? What didn’t? Use these insights to refine your strategy for future commodity trading opportunities.

The Psychological Edge in Risk Management

Emotion often proves to be a trader’s greatest enemy. Fear and greed can lead to impulsive decisions that derail even the best-laid plans. Developing a disciplined mindset is as crucial as any technical strategy.

Here’s a comparison of how different mindsets approach risk:

| Disciplined Trader | Emotional Trader |

|---|---|

| Sticks to a predefined trading plan. | Makes impulsive decisions based on market swings. |

| Accepts small losses to protect capital. | Holds losing positions hoping for a turnaround. |

| Manages position sizes carefully. | Over-leverages, risking significant capital. |

| Remains calm during volatile periods. | Experiences anxiety and FOMO (Fear Of Missing Out). |

Effective risk management in commodity trading is an ongoing process. It requires continuous learning, disciplined execution, and a commitment to protecting your capital above all else. By mastering these strategies, you empower yourself to navigate the exciting world of raw materials with greater confidence and control.

Developing Robust Commodity Trading Strategies

Building a successful approach to commodity trading demands more than just intuition; it requires a meticulously crafted strategy. For anyone looking to navigate the dynamic world of raw materials, a robust plan is your compass. At Pepperstone Commodities, we understand the intricacies involved and empower our traders with the tools and insights to develop strategies that truly perform.

A strong commodity trading strategy hinges on several core components. Let’s explore how you can build a resilient framework for your market participation:

Mastering Market Insights is your first critical step. Understanding the forces that move commodity markets is paramount. This isn’t just about reading headlines; it’s about digging deeper into supply-demand dynamics for various raw materials. Consider these key areas:

- Fundamental Analysis: Examine global economic indicators, geopolitical events, and environmental factors impacting production and consumption. For example, understanding industrial demand for gold silver oil or seasonal shifts affecting energy commodities can provide a significant edge.

- Technical Analysis: Identify patterns and trends in price charts to predict future movements. Leverage indicators to spot entry and exit points with precision.

- Market Sentiment: Gauge the prevailing mood of traders. News and social media can heavily influence short-term price action, especially in volatile commodity markets.

Next, focus on Implementing Robust Risk Management. Even the most brilliant strategy can falter without proper risk controls. Protecting your capital is non-negotiable in commodity trading. Here are fundamental practices to embed in your strategy:

| Strategy Element | Benefit |

|---|---|

| Position Sizing | Control exposure to individual trades. |

| Stop-Loss Orders | Limit potential losses on adverse price movements. |

| Diversification | Spread risk across different raw materials or market segments. |

Never over-leverage. Always define your maximum tolerable loss per trade and stick to it. This discipline is the bedrock of sustainable growth in commodity markets.

Finally, remember to Adapt and Evolve Your Approach. The markets for raw materials, from gold silver oil to energy commodities, are constantly shifting. What works today might not work tomorrow. A robust strategy isn’t static; it’s designed for continuous evaluation and adaptation.

“The only constant in the commodity market is change. Your strategy must reflect this dynamism.”

Regularly review your trades, analyze what worked and what didn’t, and be prepared to refine your rules. Utilize the analytical tools provided by platforms like Pepperstone Commodities to backtest and optimize your strategies, ensuring they remain relevant and effective.

Developing a robust commodity trading strategy takes dedication and continuous learning, but with the right approach and a supportive environment, you can navigate these markets with confidence and clarity. Join us to unlock your trading potential.

Market Volatility and Trading Hours

The world of `commodity trading` is inherently dynamic, often characterized by significant market volatility. Prices for `raw materials` can swing dramatically in response to a myriad of global events, presenting both challenges and compelling opportunities for traders. Understanding these price movements and the factors that drive them becomes paramount for anyone looking to engage effectively.

At `Pepperstone Commodities`, we recognize that navigating these volatile conditions requires precision and robust tools. Volatility is not merely about risk; it also creates fertile ground for potential gains if you can anticipate and react swiftly to market shifts. Major economic announcements, geopolitical developments, and shifts in supply and demand fundamentally influence the value of various `raw materials`.

Factors contributing to market volatility often include:- Global economic data releases (e.g., inflation reports, interest rate decisions)

- Geopolitical tensions and conflicts affecting supply chains

- Weather patterns impacting agricultural commodities

- Changes in production levels or consumption demand for `energy commodities`

- Market sentiment and speculative trading activity

- Identify periods of increased liquidity and tighter spreads.

- Anticipate potential price gaps or surges following overnight news.

- Align your trading strategy with the most active periods for specific `raw materials`.

- Manage risk effectively by knowing when your positions are most exposed.

Effective trading in `energy commodities` or precious metals hinges on this awareness. By carefully monitoring global market events and understanding how they intersect with specific trading windows, you gain a significant edge. Informed traders know precisely when to watch the charts and when to step back, ensuring they are always prepared for the next significant move.

Pepperstone Account Types for Commodity Traders

Choosing the right trading account is a pivotal step for anyone looking to enter or advance in the dynamic world of commodity trading. Pepperstone understands diverse trader needs, offering tailored options that can significantly impact your experience and profitability. Whether you’re a newcomer exploring Pepperstone Commodities or an experienced pro, selecting an account that aligns with your strategy and capital is paramount.

Let’s unpack the primary account types Pepperstone provides, specifically focusing on how they cater to traders interested in raw materials like gold silver oil.

The Edge Standard Account: Simplicity for Everyday Commodity Traders

The Edge Standard account is a popular choice, particularly for those starting their journey with energy commodities and other raw materials. It offers a straightforward approach, integrating all costs into the spread, meaning you won’t encounter separate commissions on your trades.

Here are some key advantages for commodity traders:

- No Commissions: All trading costs are rolled into the spread, making expense tracking simple and transparent.

- Competitive Spreads: While slightly wider than the Razor account, they remain competitive for general commodity trading.

- Accessibility: A low minimum deposit opens the door for many to start trading various Pepperstone Commodities.

- User-Friendly: Ideal for traders who prefer a clear, transparent pricing model without complex fee structures.

The Edge Razor Account: Precision for Experienced Raw Material Enthusiasts

For the more active and experienced raw materials trader, the Edge Razor account stands out. This account type delivers incredibly tight spreads, often starting from 0.0 pips, in exchange for a small commission per lot traded. This structure appeals to those employing high-frequency strategies or seeking minimal price friction when trading volatile assets.

Consider these pros and cons for commodity trading with an Edge Razor account:

| Pros | Cons |

|---|---|

| Extremely tight spreads, ideal for scalping and high-volume strategies. | A commission applies per lot traded. |

| Potentially lower overall trading costs for active, high-volume traders. | Requires a better understanding of total cost implications beyond just spreads. |

| Faster execution due to direct market access. | May not be cost-effective for very small, infrequent trade sizes. |

If you actively trade assets like gold silver oil or frequently engage with energy commodities, the Razor account’s tighter spreads can significantly reduce your trading overhead in the long run.

Making Your Choice: Standard vs. Razor for Pepperstone Commodities

Deciding between the Standard and Razor accounts comes down to your individual trading style, capital, and frequency. Here’s a quick guide to help you assess your needs:

“Your ideal Pepperstone account empowers your strategy, not hinders it. Consider your trading volume, risk tolerance, and how you prefer to manage costs.”

Ask yourself these key questions:

- Do I prioritize simplicity in pricing, even if it means slightly wider spreads on Pepperstone Commodities? (Consider Standard)

- Am I executing a high volume of trades where every pip saved matters for my commodity trading? (Consider Razor)

- How comfortable am I with a commission-based fee structure, and can I factor it into my profit calculations for raw materials? (Razor requires this understanding)

- What specific types of energy commodities or other assets like gold silver oil do I plan to trade, and what are their typical spread characteristics?

Both accounts provide access to a wide array of raw materials, allowing you to diversify your portfolio. They offer robust platforms and competitive conditions, ensuring you can execute your commodity trading strategies effectively.

Ready to get started? Explore Pepperstone’s offerings further and select the account that best fits your journey into commodity markets.

Funding and Withdrawal Processes

Seamless financial operations are the backbone of successful commodity trading. At Pepperstone Commodities, we recognize that swift funding and hassle-free withdrawals are not just a convenience, they are a necessity for every serious trader. Our robust systems ensure you manage your capital efficiently, giving you peace of mind to focus on market movements.

Fund Your Trading Account Instantly

Get into the market when opportunities arise. We offer a variety of secure and efficient ways to deposit funds into your trading account. Our goal is to make the process as straightforward as possible, letting you capitalize on movements in raw materials without delay.

- Credit/Debit Card Deposits: Fund your account instantly using major credit and debit cards. It’s fast, secure, and ready when you are.

- E-Wallet Solutions: Popular e-wallets provide an excellent way to deposit quickly. Enjoy rapid processing, often instant, with enhanced security features.

- Bank Transfers: For larger deposits or when you prefer traditional banking, direct bank transfers are available. While processing times may vary, this method offers high security and reliability.

- Local Payment Options: Depending on your region, we offer tailored local payment solutions to make your deposit experience even smoother.

We process all deposits with the highest security standards, ensuring your funds are safe from the moment you initiate a transaction.

Transparent and Efficient Withdrawals

Accessing your profits should be as simple as making them. Our withdrawal process is designed for clarity and efficiency, ensuring you receive your funds promptly when you need them. Whether you’ve profited from gold silver oil or other energy commodities, we make sure getting your money out is never a complex task.

Here’s how our withdrawal process works:

- Submit Your Request: Log in to your secure client area and submit a withdrawal request, specifying the amount and your preferred method.

- Security Review: Our team conducts a swift security review to protect your funds and comply with regulatory standards. This typically takes less than one business day.

- Funds Dispatched: Once approved, we promptly dispatch your funds. The time it takes for funds to reach your account depends on the method chosen.

Key Withdrawal Considerations:

| Method | Pepperstone Processing Time | Estimated Arrival Time |

|---|---|---|

| Credit/Debit Card | Within 1 business day | 1-3 business days |

| E-Wallet | Within 1 business day | Instant to 1 business day |

| Bank Transfer | Within 1 business day | 3-5 business days |

We work hard to minimize any delays. Please note that external bank processing times or specific regional regulations can sometimes influence the final arrival of your funds.

Your Capital, Your Control

Managing your capital effectively is paramount in dynamic markets. We empower you with diverse, secure, and fast options for both funding and withdrawing. This commitment to superior service allows you to trade with confidence, knowing your financial logistics are handled with expert care. Experience the difference when you choose a platform that truly prioritizes your trading success.

Accessing Educational Resources and Analysis

Embarking on commodity trading demands more than just capital; it requires knowledge. Success in these dynamic markets hinges on understanding the forces that shape asset prices and developing a robust strategy. That’s why accessing high-quality educational resources and incisive market analysis becomes paramount for any serious trader.

A comprehensive learning experience equips you to navigate the complexities of global markets. You gain insights into various raw materials, from agricultural products to precious metals, and understand the geopolitical and economic factors impacting their value. Whether you are interested in the volatility of energy commodities or the stability often associated with gold silver oil, solid education forms your foundation.

“Knowledge is your most powerful tool in the world of commodity trading. Utilize every resource to sharpen your edge.”

What Educational Resources Offer You:

- Deep Market Understanding: Learn how supply and demand, economic indicators, and global events influence the prices of raw materials.

- Strategic Development: Discover various trading strategies, from technical analysis to fundamental approaches, tailored for different market conditions.

- Risk Management Techniques: Master essential methods to protect your capital and manage exposure effectively in volatile markets.

- Platform Proficiency: Understand how to use trading tools and features to execute trades efficiently and analyze market data.

Pepperstone Commodities is committed to empowering traders through extensive educational content and expert analysis. Their platform offers a dedicated hub where you can find everything from beginner guides to advanced strategies. This commitment ensures you have the tools to make informed decisions and refine your approach to commodity trading.

Key Areas of Analysis You Should Explore:

| Analysis Type | What It Covers |

|---|---|

| Fundamental Analysis | Impact of economic data, supply/demand reports, geopolitical events on raw materials like gold silver oil. |

| Technical Analysis | Identifying price trends, patterns, and entry/exit points using charts and indicators for various energy commodities. |

| Sentiment Analysis | Gauging market mood and crowd psychology to anticipate shifts in commodity trading behavior. |

Leveraging these resources helps you not only understand the “how” but also the “why” behind market movements. It transforms raw data into actionable insights, positioning you for more confident and strategic participation in the exciting world of commodity trading with Pepperstone Commodities.

The Benefits of Diversifying with Commodities

Smart investors constantly seek ways to bolster their portfolios against market volatility and economic shifts. Diversifying your investments is not just good practice; it’s a critical strategy for long-term financial health. When you think about genuine diversification, commodities often emerge as a powerful, yet sometimes overlooked, asset class. Adding commodities offers distinct advantages that traditional stocks and bonds simply cannot provide.

Protection Against Inflation

One of the most compelling reasons to include commodities in your portfolio is their proven ability to act as a hedge against inflation. When the cost of living rises, the prices of raw materials tend to climb right along with it. This direct relationship means your investment can actually gain value during inflationary periods, helping to preserve your purchasing power.

Commodities provide a tangible asset class that often moves independently of traditional financial markets, offering true diversification.

Low Correlation with Traditional Assets

Imagine having assets that don’t always move in lockstep with the stock market. That’s precisely what commodity trading offers. Historically, commodities exhibit a low correlation with equities and fixed-income investments. This means when stocks might be experiencing a downturn, commodities could be performing well, or vice versa. This lack of synchronized movement is a cornerstone of effective diversification, smoothing out overall portfolio returns.

Market Opportunities Across Sectors

The world of commodities is vast, offering diverse opportunities. You are not just investing in one sector but across many fundamental industries. Consider the broad spectrum of options:

- Energy Commodities: Crucial for global industry and daily life.

- Precious Metals: Such as gold silver oil, often seen as safe havens.

- Agricultural Products: Essential for food production worldwide.

- Industrial Metals: Vital components in manufacturing and infrastructure.

Each category responds to different global economic factors, creating multiple avenues for potential growth. Platforms like Pepperstone Commodities make it straightforward to access these markets.

Tangible Value and Real-World Demand

Unlike abstract financial instruments, commodities represent tangible raw materials. Their value is rooted in real-world supply and demand dynamics, influenced by factors like geopolitical events, weather patterns, and global economic growth. This intrinsic value provides a fundamental base that can appeal to investors seeking assets with concrete utility.

Portfolio Performance Enhancement

Integrating commodities into a balanced portfolio doesn’t just reduce risk; it can also enhance returns. By capitalizing on different market cycles and leveraging the unique characteristics of these assets, investors can potentially achieve higher risk-adjusted returns over the long term. It’s about building a robust portfolio that can thrive in various economic climates.

Here’s a quick look at how commodities can improve your investment mix:

| Benefit | Impact on Portfolio |

|---|---|

| Inflation Hedge | Protects purchasing power |

| Low Correlation | Reduces overall volatility |

| Growth Potential | Opens new avenues for returns |

Embracing commodity trading means adding a powerful layer of resilience and potential growth to your investment strategy. Explore how these essential raw materials can transform your portfolio’s performance and stability.

Getting Started: Your First Pepperstone Commodities Trade

Embarking on your first trade in the vibrant world of Pepperstone Commodities is an exciting step. Whether you’re new to the markets or an experienced investor exploring new avenues, we make the process clear and straightforward. Our goal is to equip you with the confidence to make your initial move into commodity trading, understanding the opportunities that await.

Your Quick Setup Checklist

Before you dive into the markets, a few preparatory steps ensure a smooth start:

- Open Your Account: Complete the simple online registration process. This typically involves providing some personal details and verifying your identity.

- Fund Your Account: Deposit capital into your trading account. We offer various convenient funding methods to get you ready swiftly.

- Explore the Platform: Familiarize yourself with our user-friendly trading platform. Take time to navigate the interface, locate charting tools, and understand order types.

- Learn the Basics: Even seasoned traders benefit from a quick refresher. Understand what moves commodity prices and how leverage works within Pepperstone Commodities.

Understanding the World of Raw Materials

Commodities are fundamental raw materials that form the backbone of global industries. From the food we eat to the energy that powers our homes, these assets are constantly in demand. Trading these essential goods means you can potentially profit from price fluctuations influenced by supply, demand, and geopolitical events. Pepperstone Commodities provides access to a diverse range, allowing you to diversify your portfolio beyond traditional stocks and currencies.

“Every successful trade begins with understanding the underlying asset. With commodities, you’re trading the very essence of the global economy.”

Choosing Your First Commodity to Trade

Deciding which commodity to trade first is a key decision. Many newcomers often gravitate towards well-known markets due to their familiarity and liquidity. Consider starting with:

| Commodity Type | Examples | Key Considerations |

|---|---|---|

| Precious Metals | Gold, Silver | Often seen as safe havens, sensitive to economic uncertainty. |

| Energy Commodities | Crude Oil, Natural Gas | Influenced by global production, consumption, and geopolitics. |

| Agricultural | Wheat, Coffee | Affected by weather patterns, harvest yields, and demand. |

For instance, markets like gold silver oil are popular choices, offering considerable trading volume and ample market data for analysis. Our platform gives you real-time access to these and other energy commodities, allowing you to make informed decisions.

Placing Your First Trade: A Step-by-Step Guide

Once your account is ready and you have a market in mind, executing your first Pepperstone Commodities trade is a concise process:

- Select Your Market: Find the specific commodity you wish to trade (e.g., Gold, WTI Crude Oil) within the platform’s market watch list.

- Analyze the Market: Use our charting tools and indicators to perform your technical analysis. Review relevant news for fundamental insights.

- Determine Trade Size: Decide on the quantity of the commodity you want to buy or sell. This directly impacts your potential profit or loss.

- Set Your Order: Choose between a market order (executes immediately at the current price) or a pending order (executes when the price reaches a specific level).

- Manage Risk: Always include a stop-loss order to limit potential losses and a take-profit order to secure gains. These are crucial for responsible commodity trading.

- Execute the Trade: Confirm your parameters and place your buy or sell order. You are now actively participating in the market!

Monitoring and Managing Your Position

Placing a trade is just the beginning. Regularly monitor your open position and stay informed about market developments. Prices for raw materials can be dynamic, so adapt your strategy as necessary. Our tools provide real-time updates, helping you manage your risk and optimize your trading outcomes.

We believe in empowering our traders. Your journey into Pepperstone Commodities begins now. Explore the markets, learn at your own pace, and discover the potential that commodity trading offers. Get started today and transform your financial outlook.

Frequently Asked Questions

What types of commodities can I trade with Pepperstone?

Pepperstone offers access to a diverse array of global raw materials, including precious metals (like gold, silver, platinum), energy commodities (crude oil, natural gas), agricultural products (coffee, sugar, cotton, wheat, corn, soybeans), and industrial metals.

What are the main advantages of trading commodities with Pepperstone?

With Pepperstone, you benefit from competitive spreads, fast trade execution, access to advanced trading platforms (MetaTrader 4, MetaTrader 5, cTrader), dedicated client support, and robust regulatory oversight ensuring a secure trading environment.

How do leverage and margin work in commodity trading?

Leverage allows you to control a larger market position with a smaller amount of capital, amplifying both potential profits and losses. Margin is the security deposit required by your broker to keep leveraged positions open, ensuring you can cover potential losses.

How does Pepperstone ensure the security of client funds?

Pepperstone operates under strict regulatory oversight, including client fund segregation where your capital is held separately from the company’s operational funds. They also adhere to rigorous reporting requirements and are subject to regular audits.

What are the key costs involved in commodity CFD trading with Pepperstone?

The primary costs include the spread (difference between buy and sell price), and swaps (overnight financing charges or credits for positions held past market close). For most commodity CFDs, the spread is the main cost, with no additional fixed commissions.